CareCredit Review BEST Credit Card For Your Health

By Gavin | May 19, 2022

We have compiled some information about CareCredit credit cards in the past few days. Let's take a look at this CareCredit credit card and how it can help us see a doctor.

We will discuss this credit card and why it is such a great credit card? Why do I have it in my wallet? Why if you need a medical bill-type credit card? With these questions in mind, let's come together for a deeper REVIEW.

What Is The CareCredit

You really should have it in your wallet. So yes, the CareCredit credit card is one of the five credit cards in my purse.

I don't use this CareCredit credit card very often. Still, when I use this credit card, it means I will be spending on my health or my family's treatment, and it is probably the best credit card in my wallet.

So what exactly is a CareCredit credit card?

You can use this credit card to pay for out-of-pocket medical expenses, with unique financing opportunities that provide zero-percent financing for your medical purchases.

So basically, that's what the CareCredit credit card is for, for your health and well-being, to make sure you can be in the best health possible.

How To Use This CareCredit Card

I got this credit card about two years ago when I was at a costly dentist.

I just really liked the dentist at the time, it was a great office and everything, and he would give me the most economical treatment plan. I remember that everything he did to my teeth was about $1,500. But I didn't have $1,500 to pay them, simple as that.

I didn't have $1,500 to give them, so at the time, they had the recommendation that I use CareCredit. At the time, I didn't know what CareCredit was. Still, being a CareCredit provider, the clinic did give me a basic explanation.

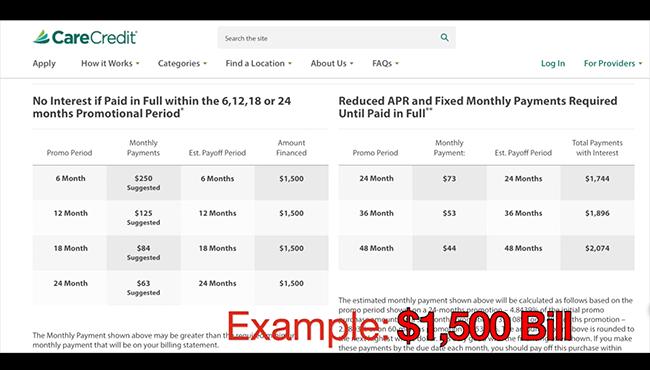

After understanding that, I knew when I applied and used CareCredit as my payment option. I could pay off $1,500 in 6 or 12, or 18 months with zero interest.

So I don't have to pay any extra money. I spend my bill slowly, month by month. If I want to pay in advance, I can do that too, and it's a great credit card for me to have.

But the main thing for me is that I don't have to pay any interest on this money. It's zero percent. So basically, after spending the $1,500 bill, that's it. I'm not paying any interest. I can pay zero interest on the CareCredit credit card for 6, 12, 18, or 24 months, as long as you use it to pay your actual bill.

If you go beyond those months, you may have to pay a little interest, but the whole goal is to pay your bill in total during that time.

You can pay those bills early with no additional fees or penalties, so that's fine.

CareCredit Carries Financing For Two Years And Beyond

You can also finance for two, three, four, or five years with CareCredit with a reduced interest rate. This can be much better than paying with another credit card with a high-interest rate, so you don't have to use cash. It's that simple.

On top of that, CareCredit offers fixed monthly payments. You don't have to worry about how much you're going to pay that month, it's the same price every month, and they'll split all the costs. You can use the mobile app to manage and view your bill.

CareCredit Providers

CareCredit also has over 225,000 providers in the United States, so I'm sure if you're looking for a doctor's office, you'll quickly find a CareCredit provider.

They have the best Walgreens for pets, Walmart, Sam's Club, Bowflex, and many other suppliers of any other product you need in your life to work with. It would help if you had CareCredit that may cover some types of medical expenses. I'm sure CareCredit has you covered for that particular need.

I'm not sponsored to say this, and they're not paying me to say this. I think it's an excellent service.

Register CareCredit Credit Card

Suppose you want to register for a CareCredit credit card. In that case, all you have to do is go to the official CareCredit website. We have to be especially careful not to apply on unofficial websites, which is the same as we use for other types of credit cards. It is needed for cyber security.

If you want to sign up for CareCredit, go to their official website. If you have a credit score of 630 or more, you will have a good chance of getting approved. It is not hard to get approved for this credit card because it is for medical expenses. They will tell you when you go to get those medical expenses.

I don't recommend you do that because, as I said before, it's a medical credit card, so don't use it for non-medical expenses. We must be careful when we use a card like that.

The whole point of this credit card is zero percent financing, and I take advantage of that every time. CareCredit is also very generous in terms of credit lines. When I first signed up for this card, I asked for about $1,500 or $2,000, and I think they could have given me about a $3,000 or $4,000 credit line.

But actually, CareCredit gave me an $8,000 line of credit, so now I'm staying at the $8,000 line of credit. I don't need the $8,000 line of credit, but it looks good on my honor, so I'll take it.

There's nothing wrong with that, I could probably get a higher line of credit right now if I wanted to, but I don't need it personally. They are very generous with lines of credit. If you need a sum of money for any surgery or anything medical-related that you need to buy, go ahead and sign up for CareCredit.

I think it's a pretty solid decision, and I highly recommend it. Suppose you have a lot of medical bills or a lot of medical expenses. So for me, that doesn't happen. Still, if it does, I have the CareCredit credit card to back me up, so I don't have to worry about paying any interest.

I don't have to worry about taking thousands of dollars of cash out of my pocket that I may have but may not want to spend at the time. It's that simple. I want to spend the $4,000 I spend in the next two years with no interest.

So if you need a care credit card, sign up for the CareCredit credit card. I think it's a great credit card.

CareCredit Convenient Online Service

Simply put, it's real quick, and on the website, they also have a payment calculator, so you can even enter how much your payment will cost. If you know the estimate or the actual amount, you can join it on the website, and they will list how much you need to pay each month and how long it will take to get the bill paid in full.

Conclusion

I have nothing terrible to say about this CareCredit credit card, and I've been using it for a few years now. It has been very reliable for me since I got it, so I highly recommend it to everyone.

Suppose you have any questions about the CareCredit credit card or your finances. In that case, I'm here for you, so keep an eye on our website for the information posted about CareCredit.